Blockchain Events

ASX Clearance Operations Rattled By Blockchain Catastrophe

Published

2 years agoon

Political and investor resentment over ASX failure to modernize the share market’s technology is threatening the exchange’s monopoly on clearing and settling cash equities market trades.

A seven-year initiative to replace the old CHESS system with blockchain distributed ledger technology was discontinued by ASX.

It would deduct $245 million to $255 million and may be required to reimburse trading companies that spent $100 million on project enhancements.

Accenture discovered numerous challenges with the project, including uncertain timeframes, communication problems with technology provider Digital Asset, and excessive complexity.

By identifying design faults and ASX’s delivery issues, the study weakened the exchange’s confidence.

Accenture’s concerns were raised so late in the project, weakening ASX’s confidence, according to ASIC chairman Joe Longo. The Reserve Bank of Australia governor, Philip Lowe, described the ASX as “very disappointing.”

Queensland Liberal Senator Paul Scarr has requested that regulators investigate if ASX’s control of critical national infrastructure creates a conflict of interest that necessitates a market structure adjustment. According to market experts, this might imply mutual ownership of clearing infrastructure.

Big investors were disappointed by Australia’s abandoned goal to be at the forefront of financial sector innovation.

A well-known investment banker described it as “globally embarrassing.” “We want to get to work. We want assurance that our systems are scalable and fit for purpose, and all of this back and forth feels like a waste of time and money.

‘Difficulties’

Damian Roche, chairman of the ASX, apologized to brokers and the market for the project’s issues but said the board had to suspend it because standards had fallen.

“Our approach will not meet ASX or market criteria,” he stated.

“Major challenges include technology, governance, and delivery. I regret on behalf of ASX for the years-long disruption of the CHESS replacement project.”

Scarr suggested that ASX apologize. The ASX should apologize to market participants who invested time and money in this initiative.

“The ASX’s board and management should consider the current situation. According to him, the Accenture investigation highlights project management challenges.”

Following a disastrous few weeks in the industry, when crypto exchange FTX fell, lowering the value of numerous cryptocurrencies that utilize blockchain technology, the ASX backed off its desire to establish a private blockchain.

ASX will investigate all options for constructing a new clearing and settlement system while retaining existing infrastructure. ASX stated that it will create an industry forum to gather feedback and project updates before deciding what to do next.

ASX put the project on hold while it reworked the solution. “All project stakeholder activities will cease, as will the industrial testing environment.”

The Accenture audit, which was commissioned in August following the project’s fifth delay, revealed that the ASX application software was only 63% complete.

It revealed an overcomplicated system design, particularly how ASX requirements interact with the application and ledger.

After paying millions to connect to the new system, stockbroking firms have begun estimating how much of their assets may need to be wiped down.

Broadridge and GBST have contractual obligations to ensure that broker clients are prepared to upgrade to new market infrastructure.

What has been spent and what is still available? “Understanding what led to ASX’s decision and determining what can be kept will be a primary focus,” Stockbrokers and Investment Advisers Association CEO Judith Fox said.

Companies that want to develop with distributed ledger market data are dissatisfied since they will be stuck with the outdated system for an uncertain period of time.

Delay after delay has demonstrated that establishing a new tech platform requires a robust tech function. The decision, according to Paul Williams, CEO of Automic Group, which was developing new registry services in ASX’s testing environment, demonstrates that ASX is not that.

“We’re still operating on a 25-year-old platform with no automation, resulting in system disruptions and inefficiencies.” There is a cost, but I am upset that we will continue to use old technology.

The Australian Securities and Investments Commission and the Reserve Bank of Australia stated that the ASX’s decision “marks a significant setback to the replacement of critical national infrastructure for Australia’s cash equity markets and now brings into sharp focus the longevity of the existing CHESS platform.”

ASIC and the RBA jointly wrote ASX a letter stating ASX’s expectations for the current CHESS system’s stability, robustness, and endurance.

They have requested that ASX enhance its program delivery capabilities and that the CHESS replacement program “be brought back on schedule after the solution design is finalized.”

Dr. Lowe described the ASX news as “disappointing” after years of investment. “ASX must develop a new strategy to ensure safe clearing and settlement infrastructure.”

ASX will now go back to the drawing board to determine whether blockchain can still play a role in settlement and clearing, or whether another technology is required. It hasn’t been working on a “Plan B” in parallel with the project.

ASX chose Digital Asset Holdings to develop the distributed ledger in 2017 after examining the technology in 2015. There is a lot of optimism about blockchain’s ability to create market efficiencies by eliminating intermediaries.

It was intended to be on sale in April. It was frequently delayed because the system did not meet market demands. Trade settlement was hampered by insufficient throughput.

Because the planned technology couldn’t connect to independent settlement and clearing systems, ASX struggled to reduce market expenses. Existing registries and custody firms are concerned that the ASX will take away their roles.

The ASX will explore using Digital Asset and VMWare in any improved system, but it will keep all alternatives open.

The announcement has “disappointed” ASX CEO Helen Lofthouse. “We’ll think about it again. We are looking for the best solution for the Australian market and will conduct a thorough and deliberate analysis of the choices.”

The derecognition fee reflects the current solution design’s future worth. It does not preclude us from using previously generated elements as long as we can alter our current design to match ASX and market standards, she explained.

ASIC and the RBA want ASX to actively interact with the industry during the new process “to ensure market confidence in its selected implementation choice, delivery strategy, and timeframe.”

The authorities will contact directly with the brokerage industry to ensure that ASX takes their views into account.

According to Mr. Longo, the examination revealed significant gaps and inadequacies in ASX’s program delivery skills and technological design.

“It’s regrettable that these findings came so late in a critical replacement program.”

“To date, ASX has failed to exhibit effective program control, casting doubt on its ability to deliver world-class, modern financial market infrastructure.”

Former Westpac executive Tim Whiteley has been nominated project director for the second phase of CHESS replacement to improve ASX’s project management capabilities. ASX will continue to invest in the current CHESS system, but it will eventually need to be replaced.

According to ASX, the independent audit emphasized the project’s “scale and complexity.” It raised “vendor management problems,” such as how the ASX and Digital Asset teams “operate and interact, causing delivery challenges.”

It comes after a difficult period for ASX, whose share price is down 23% this year due to growing regulatory and political scrutiny and new leadership, following the departure of former CEO Dominic Stevens and much of his senior leadership team. The AGM in September marked the ASX board’s first strike.

The ASX closed 0.2% down at $71.00, reversing a 3% loss. According to ASX, the write-down is significant and will not influence dividends. The stock was rated outperformed by Macquarie.

ASX said in a separate release on Thursday that it has terminated 72,283 performance rights in response to shareholder demands for management accountability for the issue. Mr. Stevens and previous deputy CEO Peter Hiom will continue in their roles until May 2021.

For More Blockchain News, Click Here.

You may like

Blockchain Events

DAVOS 2023: Blockchain’s Potential Beyond Cryptos

Published

2 years agoon

January 18, 2023

DAVOS 2023: At #WEF23, policymakers and business leaders were eager to distinguish between distributed ledgers and cryptocurrencies. Not crypto, but blockchain.

From climate solutions to humanitarian aid to moving on from FTX’s stunning collapse, the second day of the World Economic Forum’s 2023 annual conference saw discussions focused on the promise of the technology underlying cryptocurrencies, rather than the often speculative financial assets themselves.

The day opened with a panel of traditional banking professionals seeking to draw a line under the FTX issue, noting that, while the cryptocurrency industry is in crisis, other products founded on distributed ledger technology are not.

“It’s critical not to mix cryptocurrencies with CBDCs, stablecoins, and DLT… they’re all quite distinct,” PayPal President and CEO Dan Schulman stated. Despite the bitcoin crisis, “the underlying tech has operated well,” according to Schulman.

“The promise of a distributed ledger is that it may be faster and cheaper to settle transactions concurrently with no middlemen. That is really significant.”

Importantly, unlike past waves of “blockchain, not bitcoin,” which generally referred to permissioned blockchains, the talks on Tuesday were OK with public ledgers such as Ethereum and the Stellar network. Lynn Martin, President of the New York Stock Exchange, seems to adopt a similar stance, citing the potential benefits of blockchain in making share issuance more efficient or allowing financial exchanges to be settled quickly rather than days later.

“Some of the technologies have now been embraced and used to truly make processes considerably more efficient,” Martin added.

Former Indian central bank governor Raghuram Rajan later repeated that promise of broader blockchain uses.

However, TradFi’s commitment to the industry may eventually be tested: When questioned, Schulman, Martin, and State Street’s Ronald O’Hanley all claimed artificial intelligence, not blockchain, was the most exciting technology.

Carmen Hutt, treasurer for the United Nations High Commissioner for Refugees, detailed such an application – a recently launched blockchain payment solution for distributing humanitarian aid in Ukraine – just across the street from the forum’s main congress center, in a historic church transformed into a neon hub for hosting discussions about the future.

Hutt revealed during a panel discussion hosted by CoinDesk chief content officer Michael Casey that the pilot project, which was launched in December using the blockchain platform Stellar network, is significantly more sophisticated than one might assume.

Donations via the blockchain promise “transparency and visibility,” and the Commission has a platform ready to send relief immediately, according to Hutt. “What an incredible offer… We can deploy $500 million today if we acquire $500 million. So this isn’t going to take weeks or months,” Hutt explained. (Later that day, Ukraine’s deputy prime minister praised the contribution of virtual money to the military effort.)

Further along the legendary “promenade,” industry heavyweights ranging from Solana and Ripple to the Global Blockchain Business Council teamed together to develop a climate project that would use blockchain’s transparent record-keeping to assist in improving carbon emissions and credit tracking.

Although authorities have mostly focused on the potential of crypto contagion to financial stability, a string of bankruptcies last year that wiped out billions of dollars in retail investments, most notably Sam Bankman-FTX, Fried’s may have underlined the need for a shift in their focus.

For the lone banker on the conventional finance panel, the events of 2022 must shift regulators’ focus away from the risk of lenders bringing down the whole financial system and toward the risk of individual customers being duped by crypto frauds. “It’s not that regulators have disregarded [financial innovations], but if it’s not going to generate systemic danger, I’m not sure why we should focus on it.” For More Blockchain News, Click Here.

Blockchain Events

Blockchain to Revolutionize Supply Chain Management

Published

2 years agoon

January 17, 2023

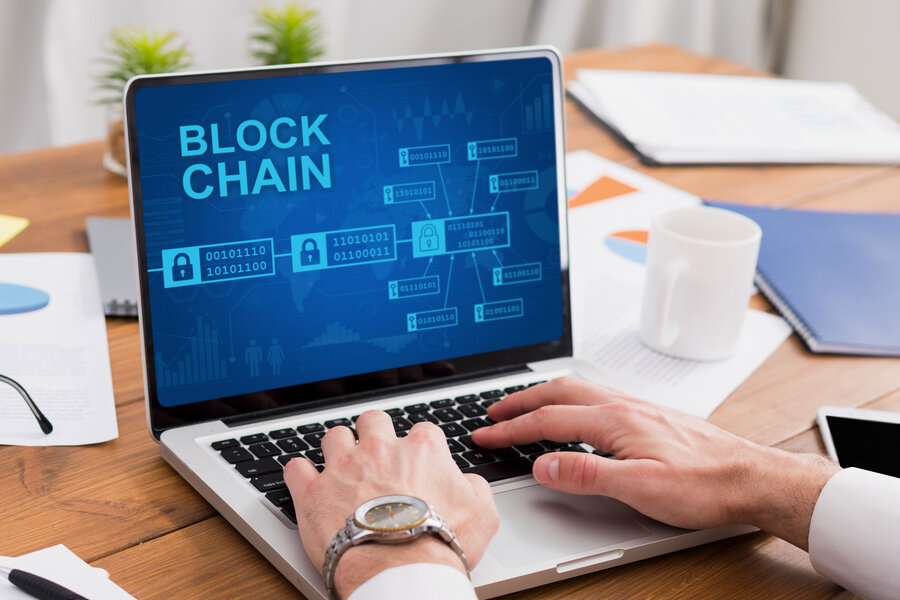

Blockchain has become increasingly prevalent in recent years, with applications spanning from new cryptocurrencies to their potential uses in various sectors, making it important for business leaders, industries, and regulators to have a deeper understanding of the technology and its potential applications.

While blockchain has yet to achieve widespread acceptance, it has the potential to drive significant digital transformative changes and generate new possibilities throughout the corporate landscape, from banking and finance to infrastructure and healthcare.

Blockchain is defined as “a distributed ledger that records transactions chronologically and publicly,” according to one source. Its database is shared across a network rather than being held in a single location, which enables a high level of information control and transaction transparency.

However, there has been so much hype surrounding blockchain on all sides of the debate, that it has become increasingly difficult to separate fact from fiction.

A study by Vorhaus Advisors, a Los Angeles-based digital media consulting firm, found that only 25% of people in the United States understand what blockchain is.

According to the same poll, 62% of people believe blockchain is the same as cryptocurrency, and 48% believe it is the same as bitcoin.

This lack of understanding of blockchain has caused confusion, skepticism, and fear about its use, which spreads across all sectors of industry and government, influencing not only business but also policy.

The fact is that blockchain technology has the potential to fundamentally alter how organizations and individuals trade products and information, and part of that revolution is already underway.

Blockchain has the potential to improve any business in which transactions require a permanent record and the confidence of many parties. Furthermore, it has the potential to dramatically simplify paper-intensive enterprises that require an accounting ledger.

Here are three real-world blockchain use cases to illustrate how adaptive, widespread, and disruptive it can be:

- Banking and Finance: Finance and banking have received the most attention regarding blockchain and for good reason. It’s an entirely transactional industry. For example, blockchain can convert paper-based functions such as letters of guarantee (documents provided by a bank that assure suppliers be paid for the goods or services they supply in the event that the payor is unable to pay) into a totally paperless, digital, and transparent process, helping to eradicate fraud and forgeries.

- Rethinking Healthcare: The pandemic’s unexpected demand for remote healthcare and other medical-related activities has moved the emphasis on delivering clinical treatment in a virtual or data-driven manner. As a result, the various medical data silos across healthcare providers can be integrated into a single shared blockchain network for secure and efficient data sharing.

- Supply Chain: Blockchain can also be used to improve supply chain management. A blockchain network can provide a single source of truth for the entire supply chain, from the origin of raw materials to the final delivery of goods to the customer. This can help to improve transparency, traceability, and efficiency in the supply chain.

In conclusion, blockchain is a powerful technology that has the potential to transform many industries, but it is important to separate the hype from reality. It is essential for business leaders, industries, and regulators to have a deeper understanding of the technology and its potential applications to fully harness its potential.

For More Blockchain News, Click Here.

Blockchain Events

Blockchain Boom: 90% of Businesses Now Using the Technology

Published

2 years agoon

January 13, 2023

According to the findings of a recent survey that was carried out by CasperLabs, it is anticipated that business adoption of blockchain technology will increase over the course of the following year in the United States, the United Kingdom, and China.

This is the case even though there are knowledge gaps.

Despite the fact that the cryptocurrency and blockchain industries have undergone significant change over the course of the past year, people and companies continue to display an interest in the area.

The results of a recent poll that was conducted by CasperLabs and Zogby Analytics revealed that businesses had a particularly upbeat outlook on the potential applications of blockchain technology.

The questionnaire was sent to a total of 603 “decision makers” employed by a variety of commercial firms in China, the United Kingdom, and the United States of America, in that order.

Almost all of the businesses that were asked about their usage of blockchain technology responded that they did so in some form, and almost all of those businesses (87%) also stated that they intend to make financial investments in blockchain technology during the next 12 months.

This phenomenon is especially widespread in China, where more than half of the respondents want to put money into blockchain technology by the year 2023.

According to Ralf Kubli, a member of the board of directors for the Casper Association, businesses are continuing to look to blockchain technology for solutions despite the recent turbulence:

“It is incredibly heartening to see businesses recognize that blockchain technology is not a threat but rather a solution,”

Companies who are now implementing the technology are reaping the benefits of two of its primary characteristics, namely security (42%) and copy protection (42%), both of which are proving to be highly useful for these organizations.

Those who work in IT-based operations are using blockchain technology for a variety of reasons, including but not limited to improving the efficiency of internal processes (for which 40% of users employ it), improving the efficiency of supply chain operations (34% of users employ it), and improving the efficiency of software development (30% of users employ it).

According to Kubli’s projections, the year 2023 will mark a pivotal turning point for the widespread use of blockchain technology, particularly in terms of offering practical answers to real-world challenges and producing long-term value.

In spite of this, a significant study shed light on the flaws that are commonly seen in CEOs of corporations. The vast majority of respondents (73%) feel confident in their comprehension of blockchain technology.

Despite this, 54% of those who replied continue to regard the words “blockchain” and “crypto” as being identical. In spite of the fact that the vast majority of respondents feel positive about their comprehension of blockchain technology, this is the result.

In a similar vein, it has been argued that the most significant obstacles to adoption are a lack of developer talent, a lack of tools, a lack of interoperability, and pessimism regarding the industry as a whole.

All of these factors contribute to a general sense of pessimism.

In spite of this, practically all of the people who took part in the survey stated that they would be more receptive to embracing blockchain technology if they had a better grasp of how their coworkers are utilizing it.

Education, in addition to accessibility, has been a challenge and a barrier for a significant amount of time for those people outside the space who seek to interact with the technology and engage with customers. This has been the case for many different causes throughout history.

For More Blockchain News, Click Here.

You must be logged in to post a comment Login